You need a reliable and knowledgeable team that knows the entire compliance process. An experienced outsourced back-office accounting services team can do the work for you. Our hospitality-specific accounting system is powered by accounting professionals with restaurant backgrounds who help operators increase profits.

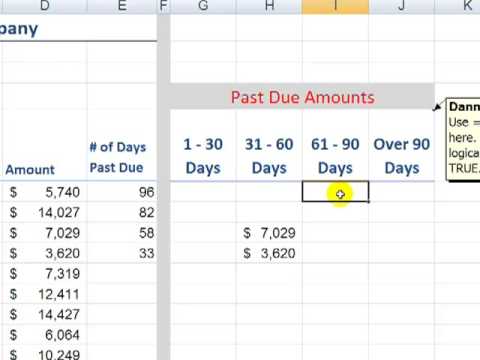

Back office support ensures that the front-end operations can function efficiently by providing the necessary infrastructure, resources, and assistance. In essence, while back office accounting is a subset of back office support, the latter includes a wider array of services crucial for overall business functionality beyond just financial tasks. Firstly, it enhances operational efficiency by streamlining financial processes such as accounts payable, accounts receivable, and payroll management. This reduces manual errors and frees up valuable time for employees to focus on more strategic tasks.

COVID-19: Now Real Estate & Restaurant Businesses Turn to Remote Accounts Payable Services for Improved Cash Flow

Back Office Accounting service Specialists give the same priority and equal level of service standards for every client. We are very keen on the accuracy, safety, and security of the work delegated to us. Back Office Special Accountants has a team of QuickBooks specialists who can provide you a guided QuickBook assistance and valuable expert suggestion. The experts at Back Office Accountants can help you out in using different versions of QuickBooks with several available tools.

Schedule an intro call with our team to find out how our Back Office Accounting services can support your business growth and goals. It’s a stepping stone in your business growth, helping you get timely and accurate financial results to fuel your business growth and increase profitability. We assign an accounting leader to your business who, with the help of additional bookkeepers, focuses on these tasks while also providing phone, email, and text support.

The #1 outsourcing authority

We ensure that your bookkeeping is up to date and that your personalized tax advice is based on real, accurate numbers. For existing LLCs and LLCs already filing with the S election, there is a one time Business Success Upgrade fee of $399. This fee goes toward ensuring that your business is set up correctly, registered with the appropriate agencies, and in compliance with payroll requirements.

That can be done by connecting your back-office functions (ERP)—namely financials, billing, and product and service delivery—to your front office (CRM), so you can create a comprehensive view of your customers. Eliminating back office bottlenecks—and transitioning to a modern back office—is one of the most important things you can do for your business. It empowers finance to go beyond compliance and control and unlock new revenue models. It also delivers operational efficiencies that can reduce O2C and DSO. Overall, your modern back office delivers a high ROI that can improve your bottom line in just a few months.

Our staff accountants effectively manage your back-office needs by combining strong accounting knowledge and efficient application of tools. NDH’s training and standard work templates Back office accounting help ensure an accurate and efficient work product. Getting it right the first time saves you the cost of rework typically required using temporary agencies or service bureaus.

Get Your First Month of Bookkeeping for FREE!

Instead of waiting days or even weeks for teams to be in sync, everyone from sellers to accountants can do their work with the same view of critical customer data. Finance teams often rely on Excel because their ERP platforms are missing key features. For example, a growing number of businesses have introduced subscription-based and hybrid pricing models.

Our staff has perfect knowledge of accounting standards and advanced regulations, work on your project; finish your task within your required time frame and send you across. We ensure you timely delivery of the work which helps your business to build a better customer relation and business reputation. With Trams® Back Office, you will have the capability to easily monitor, manage and grow your business. Trams® provides right-size, right-price information technology (IT) solutions and is one of the most popular back office accounting and reporting systems on the market today. It’s easy to learn and use, helping you control costs with extreme efficiency. At MoneyPenny, we can help streamline your business by providing back-office firm administration services.

It can be particularly advantageous for small and medium-sized enterprises (SMEs) that may not have the resources to maintain an in-house accounting department. However, careful consideration of the outsourcing partner, data security, and regulatory compliance is crucial when making this decision to ensure a successful and smooth outsourcing experience. Back-office accounting is crucial for the smooth functioning of any organization. It forms the foundation of financial management by handling tasks essential for maintaining accurate records, financial compliance, and informed decision-making. While front-end operations drive revenue, back-office accounting ensures its efficient allocation and utilization.

- These statements, including the balance sheet, income statement, and cash flow statement, are essential components of financial reporting.

- Other than that you can log on to our webpage to know the detail of our company, our vision, the work history and detail of our service team for all your assurance.

- Many businesses choose to outsource their accounting functions to third-party service providers.

- They keep your books updated so that you always have current financial information.

- In this article, we’ll delve into the advantages of getting outsourced back-office accounting services.

- Meet your accounting and tax team, who will help you set up your payroll, bookkeeping tools and file your business and personal tax returns.

We perform the best to keep you at the top position among the list of your competitors. Hiring us you won’t miss performing any legal requirement and business regulation. Our customers can access the accomplished work from anywhere at any time through connecting their system to the internet. Our greatest marketing strength is our client’s trust and customer satisfaction. Many business school students from non-target colleges and universities see Back Office work as a way to gain experience within a firm and potentially network up into the Front Office roles.

Back Office Accounting Services

A modern back office is instrumental in transforming finance from a cost center to a value center. With the data available in a modern, unified platform, finance can provide valuable insights on pricing models, product and service performance, and customer behavior that can increase deal size, margins, and renewal rates. With workflow automation, a modern back office allows finance to dramatically improve efficiency, reducing O2C and DSO.

At some point, you need professional accounting support if you want to take your business to the next level. When you started your business, you may have taken on all of the accounting tasks on your own. But as your business grows, so do the complications in the back office. With the right ERP, these companies realize improved margins and reduce fulfillment time.

A back-office team reduces the workload of your in-house employees. They can take on finance and accounting tasks your team has little to no experience in doing. They can also do some of the administrative tasks related to your business finance and accounting needs. A back-office support team provides you with financial flexibility. The team already has the experience and skills to get the job done as soon as you hire them.

See if Back Office Accounting is right for your business.

It entails recording, classifying, and summarizing financial transactions, which forms the foundation for generating financial statements. These statements, including the balance sheet, income statement, and cash flow statement, are essential components of financial reporting. Back office accounting ensures that transactions are correctly entered into the accounting system, adhering to accounting principles and standards.

Typically the bookkeeper works on things like processing invoices, reconciling bank statements, chasing customers for payment, posting journal entries, preparing or checking VAT returns, and so on. However, the Covid-19 social distancing requirements mean that some clients are no longer able to allow the bookkeeper into their premises. This is leading to a backlog of processing which in turn increases the likelihood of gaps and errors in records as time goes on. We will help you optimize your small business back office efficiency to improve operations, streamline technology and leverage financial information to accelerate your company’s growth. The price includes filing a single-member LLC and S Corp tax election, getting your EIN number, monthly bookkeeping services and financial reporting. You also get your very own accounting and tax advisor, who will file your business taxes and give you year-round tax support.

For the full year ended December 31, 2019, the new standards for revenue recognition will become audit guidance for non-public companies (public companies have reported under these standards since 2018). Our back office accounting team consists of CPAs or professionals with similar experiences and backgrounds. Formed to help you be more productive, competitive & profitable, we focus on developing solutions that meet the needs of today’s fast-paced businesses. This locally installed solution allows your agency to effectively manage your entire accounting and reporting process.

- Certinia ERP is a customer-centric, end-to-end enterprise resource planning solution built on the Salesforce platform.

- At MoneyPenny, we provide outsourced financial reporting for business owners who need help managing their financial records.

- Utilize results to make educated decisions that facilitate growth and profitability within your restaurant.

The back office plays a crucial role in supporting the front office (think sales/trading desk) by processing the trades made by customers of the bank or for the banks’ own proprietary trading operations. Some of the functions of the back office are confirming trades and settlement instructions, clearances, record maintenance, regulatory compliance, accounting, and IT services. The primary goal of your back office software is to optimize and automate the processes across each of these functions to boost operational efficiency and company profitability. It can be difficult to keep up with your finances while trying to focus on managing an organization. Our outsourced back office accounting services can help you by providing experienced staff accountants from a firm with more than 50 years of accounting experience. As a business owner focused on managing operations and creating shareholder value, you seldom have time to oversee your accounting department.

Comprehensive legal framework soon to make GIFT City global hub for accounting, financial back-office… – Moneycontrol

Comprehensive legal framework soon to make GIFT City global hub for accounting, financial back-office….

Posted: Sat, 19 Aug 2023 15:25:06 GMT [source]

The intellectual mind and hard work of our accounting team can help you to get your work done remotely. With more than 35 years of combined experience in bookkeeping, accounting, tax prep and secure communications, we know your pain and can provide you the space to put your energies where they are needed. Certinia applications, which include Finance, Billing, and Revenue Recognition, are built to run on the Salesforce Platform.

You can get your task done in stipulated time with perfect accuracy and diligence. Considering us you will never go to miss legal compliance which causes you financial loss or loss of business reputation. Founded in 2003 by three former Arthur Andersen professionals, NDH is a skilled professional services firm providing accounting and tax solutions to a sophisticated clientele.